After Decade-Long Push, Governor to Sign Landmark Military Pension Tax Cut

Vermont is the next-to-last state to act on the issue of fairness to those who have served and an economic necessity to retain and attract a valuable part of the workforce.

After a nearly decade-long effort, Vermont is set to enact the most significant tax relief for military veterans in a generation. Governor Phil Scott will sign S.51 into law at a State House ceremony tomorrow, marking a hard-won victory for advocates who have long argued that Vermont’s tax code was out of step with the rest of the nation.

The bill’s signing, scheduled for noon on Wednesday, will cap a legislative journey that saw overwhelming bipartisan consensus. The new law, effective for the 2025 tax year, will eliminate state income tax on military retirement and survivor benefit pay for the vast majority of Vermont’s veterans.

For years, Vermont remained one of the least generous states in its treatment of this income. The breakthrough comes after persistent pressure from the governor’s office and Republican lawmakers, who framed the issue as both a matter of fairness to those who have served and an economic necessity to retain and attract a valuable part of the workforce. The final bill represents a legislative compromise that, while not a full exemption for all, fundamentally changes the financial landscape for thousands of Vermont families.

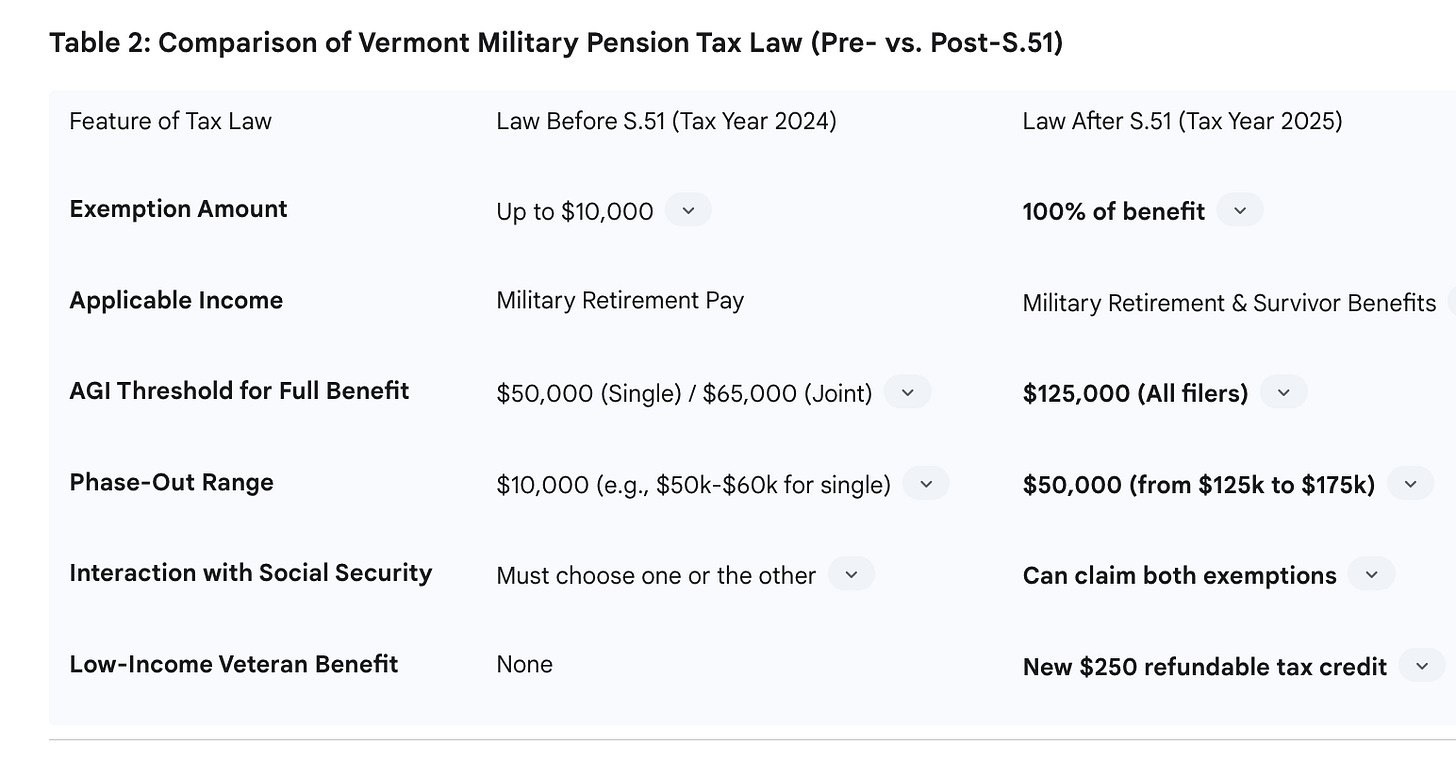

The new law replaces a restrictive and confusing system with two major provisions. First, it creates a full, 100% state income tax exemption on military retirement and survivor benefit income for any household with an Adjusted Gross Income (AGI) of $125,000 or less. The benefit gradually phases out for those earning up to $175,000. Previously, the state offered only a small $10,000 exemption with income caps so low—$50,000 for single filers—that many retirees saw little or no benefit.

Second, the bill creates a new $250 refundable tax credit specifically for lower-income veterans who may not have military pensions. This ensures that veterans facing financial hardship receive direct support from the state.

The long delay in passing such a measure often came down to fiscal concerns in a state with a tight budget. The final version of S.51 found a path forward by being bundled with other popular tax relief measures, including an expansion of the state’s Child Tax Credit, which broadened its political support. The decision to target the relief to middle-income retirees, rather than a universal exemption for all, was the key compromise that made the bill fiscally and politically viable in the 2025 session.

While the new law is a major step forward, it does not make Vermont the last state to act. The state now joins a large group offering a "partial exemption." The distinction of being the final holdout currently belongs to California, which is the only state with an income tax that provides no specific relief for military pensions. However, even that is likely to change soon, as a bill to create a partial exemption has already passed the California State Assembly and is pending in the Senate.

For Vermont’s military retirees, tomorrow's signature will be the culmination of years of waiting, finally aligning the state more closely with the national trend of honoring military service with meaningful tax relief.